Indirect Materials And Indirect Labor Are Classified As Blank______. – {error:true,iframe:true} manufacturing costs of job order cost systems from chapter 5 / lesson 2 4.3k job. Nevertheless, they must back the production and manufacturing. Indirect materials are part of overhead, which we will discuss later. Indirect labor refers to employees not directly involved in the finished goods or services production procedure.

Indirect materials and indirect labor are classified as manufacturing overhead in cost accounting. Concept explainers question transcribed image text: Business accounting accounting questions and answers indirect labor and indirect materials are classified as a. Indirect labor and indirect materials are classified as manufacturing overhead and product costs.

Indirect Materials And Indirect Labor Are Classified As Blank______.

Indirect Materials And Indirect Labor Are Classified As Blank______.

All expens.view the full answer 49 terms obenham preview december 2020 test odl objective teacher 17 terms adamnaqi02 preview accounting chapter 2 32 terms michael_vento4 preview chp 8 8 terms faisalk97 preview supply chain exam 2 32 terms sophie8784 preview Indirect materials and indirect labor are classified as manufacturing overheads.

Direct labor would include the workers who use the wood, hardware, glue, lacquer, and other materials to build tables. Indirect materials, indirect labor, and overhead. 01/23/2023 business high school verified answered • expert verified indirect materials and indirect labor are classified as ______.

Direct labor as with direct material costs, direct labor costs of a product include only those labor costs. The cost of materials necessary to manufacture a product that are not easily traced to the product or not worth tracing to the product. Study with quizlet and memorize flashcards containing terms like financial accounting is for __________ users, managerial accounting is for _____________ users, ex of external.

Indirect material costs are derived from the goods not. Factory overhead and product costs b.

What is Direct and Indirect Materials? YouTube

PPT An Introduction to Managerial Accounting and Cost Concepts

What Is The Journal Entry For Indirect Labor slidesharedocs

What Is Indirect Labor Cost? Explained

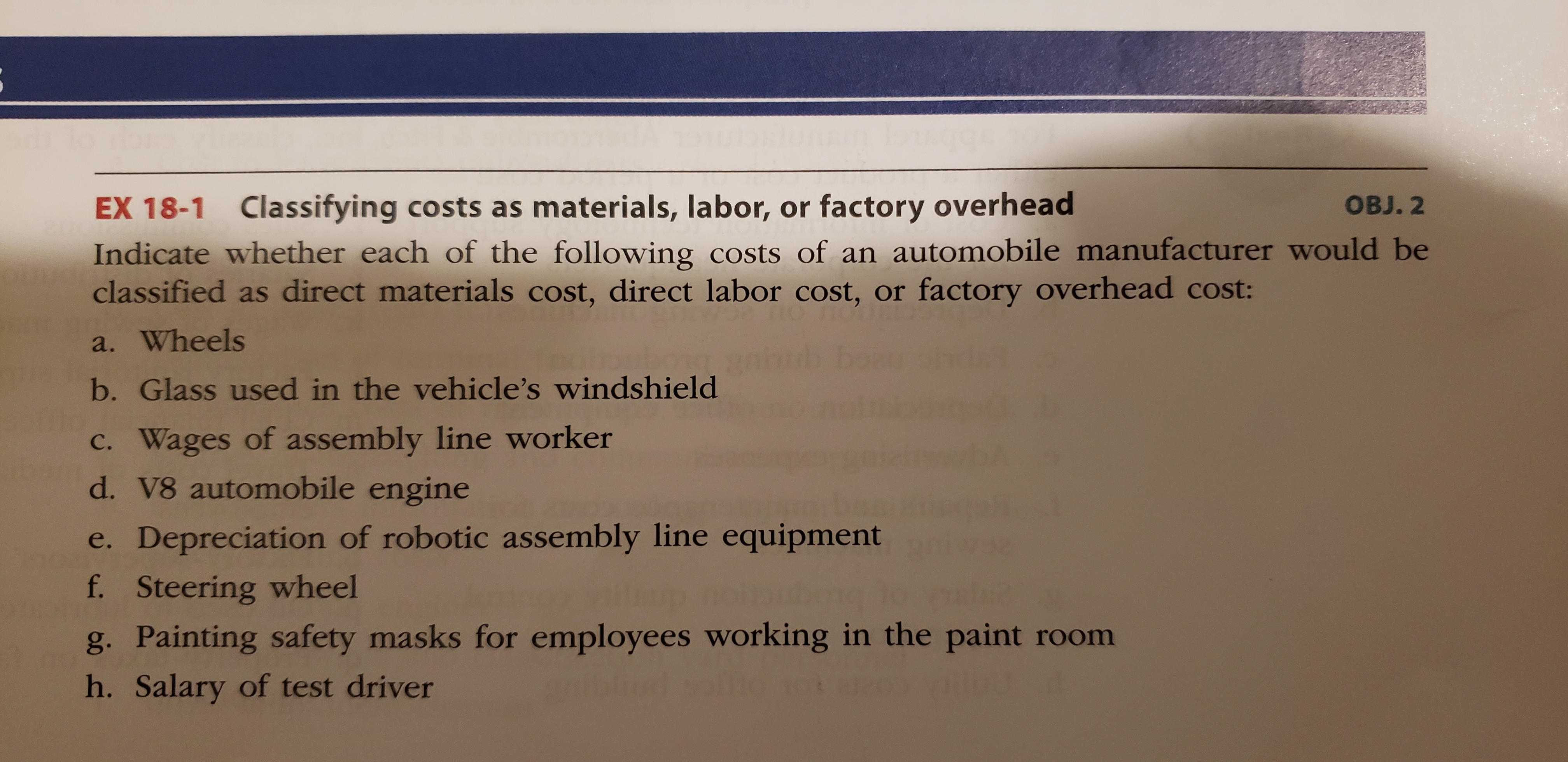

Answered EX 181 Classifying costs as materials,… bartleby

PPT Contracts EECE 295 PowerPoint Presentation, free download ID

ACCA MA (F2) Notes C1bi. Direct and indirect costs of labour

What are indirect materials? Definition and examples

Elements of cost Direct and Indirect Material, Labor, & Expenses

Solved The costs of indirect materials are classified as A)

PPT Management Accounting A Business Partner PowerPoint Presentation

What is indirect labor? Definition and examples Market Business News

Indirect La

bor Costs Definition Types Formula & Calculation

Solved Materials and Labor Variances At the beginning of the